After we pass, most of our assets will be frozen, and will require Court Approval before they can be unfrozen and given to our beneficiaries.

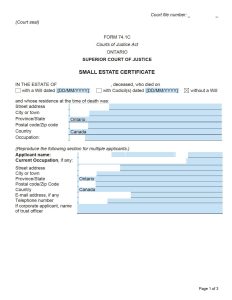

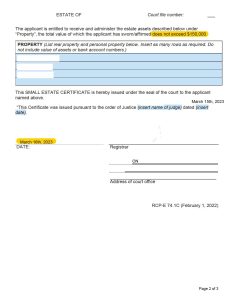

This “unfreeze process” is done through a probate application. If the total estate assets is $150,000 CAD or lower, then it’s considered to be small estates.

Small estates probate application is much easier and cheaper than normal estate probate applications.

There are a few types of assets that are excluded, when calculating whether your estate is $150,000 or less:

- Any joint accounts, including joint bank accounts, joint real estate accounts – the beneficiaries only need to visit the banks or real estate law firms to transfer those accounts – no Court Approval required

- Any estate assets with a designated beneficiary, such as life insurance, TFSA, RRSP – again, the beneficiaries only need to contact the insurance companies and banks to transfer those accounts – no Court Approval required.

Additionally, for larger estate assets that require secure transactions, such as properties that were not jointly held, utilizing real estate secured lending can facilitate a smoother and more reliable transfer process under the eyes of the law.

But other account types, such as bank accounts and vehicles under only the deceased’s name, require Court Approval to be passed. If their total value is $150,000 or lower, than we can apply for a Small Estate Application.

Our current client was in this situation.

A Small Estate application is much easier and cheaper than a normal estate application; in our firm, the legal fees are 50% of a normal estate application, and the court processing time is also much shorter.

We are joyous that we got the approval document for this family inexpensively, and within a short time.

If you want to know more about small estate application, please read our blog here.