Book a Free

Consultation!

Consultation!

Trusted Wills and Estates Lawyer

Do you want to know more?

Get the first consultation for free

If you’re looking to understand more about the options you have when it comes to Wills and Estate Planning, read on and we’ll walk you through it (with examples!) Just scroll down to read below.

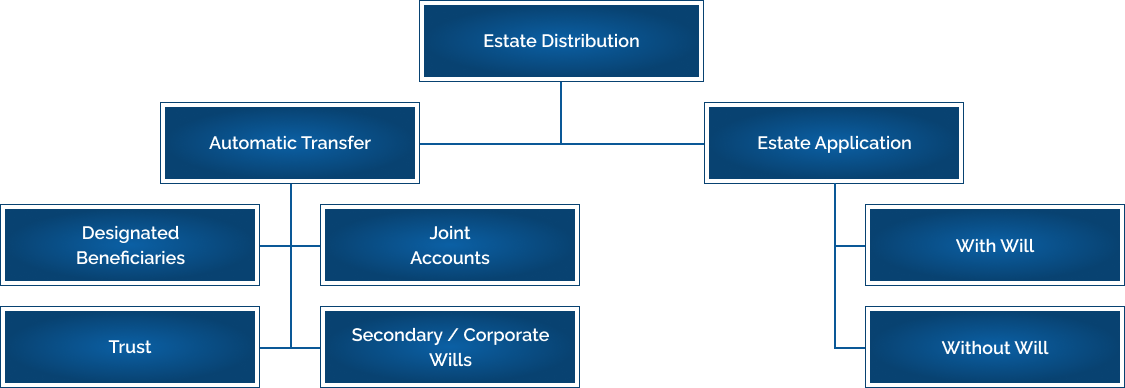

Automatic transfer – Upon our passing, our beneficiaries can immediately receive our estate with a death certificate – there is no need for estate application to the court nor a will – however, automatic transfer have problems, such as giving beneficiaries control too early (by adding them as joint accountholder)

Estate Application – Upon our passing, our beneficiaries must submit an estate application – this process is much easier with a Will and usually Courts will not require a bond when there is a valid Will (bond policies are very expensive and difficult to get)

Passing on Your House: Deed vs. Will

Steps to Get Your Inheritance

Sam:

- bought life insurance for his daughter, Sarah

- set up his house as joint tenants with Sarah

- put all of his liquid funds into a family trust,

- and created a corporate/secondary will for his business assets.

Because Sam did all of this planning before-hand, upon his passing, Sarah would get all of his assets automatically. This means Sarah does not need a Will and does not need to apply to the Court for probate, which is a complex and lengthy application. Probate is required for all estate assets that are not set up to be automatically transferred to Sarah.

This whole automatic transfer only took a week. All Sarah had to do was show the life insurance company, our law firm (Varity Law), and the bank Sam’s death certificate to inherit all his personal and corporate assets. Sarah also didn’t need to pay the probate taxes (for assets above $50,000 – it’s currently 1.5% of the entire estate).

However, there are also 2 disadvantages to setting everything as automatic transfer:

- At the moment Sarah was added to the deed of Sam’s property, Sarah can veto any of Sam’s decisions regarding the property – Sam cannot sell, rent, or mortgage the property without Sarah’s agreement. This immense power to Sarah does not happen after Sam passes away, but happens right after she was added to the deed

- Income tax problem: Sarah already has property A under her name; when she became joint owner to Sam’s property B, that property became her investment property; principal residences can be sold tax-free, but investment properties require payment of capital gains when sold; in contrast, if Sarah received property B through probate, she can sell property B under the deceased Sam’s name as his principal residence, which would be tax-free, and she would get the sale money tax-free

This is the ideal set-up for many of our clients.

Mary:

- bought life insurance for her son, Manny

- set Manny as designated beneficiary to her TFSA and RRSP

- drafted a valid Will through our firm (Varity Law), using which she left everything else, which are her principal residence and several bank accounts, to Manny; there is a mortgage on her principal residence

Mary did not want to set Manny as joint account holder to her bank accounts, because at the moment Manny is added to her bank accounts, he can use the money immediately. What if he squandered all that money before she passes away?

After Mary passed away:

- Manny first got all the automatically transferred assets, which are life insurance, TFSA, RRSP

- Then he hired Varity Law to do a probate with will application for Mary’s house and bank accounts – since we drafted a valid Will and we are experienced with probate, he got the approval within one month

- With the Court approval (a certificate is issued), Manny got all the money in Mary’s bank accounts

With the real estate, Manny decided to do the tax-free way. He hired Varity Law to sell Mary’s property under her name, as the Estate of Mary. Since this is her principal residence, it was sold tax-free, and Manny received the money from the sale tax-free.

As well, the mortgage on the property could not be paid until the house is sold. Mortgage is an income-tested debt, meaning that it could not be transferred to Manny. Upon Mary’s death, Manny had to figure out a way to pay out all the mortgage immediately, not on a monthly basis. Luckily, Mary was smart enough to give him life insurance, TFSA, and RRSP. He used those money to pay out the mortgage and avoided the mortgage penalties.

With this plan, Manny got Mary’s estate assets in the most time-efficient and tax-efficient way, and he avoided any unnecessary penalties for the estate debts.

This is the hardest situation.

Gale passed away without a Will, and without setting any estate assets to be automatically transferred. His wife, Gabby, can only receive his estate assets by filing a probate without will application, which our firm completed for her.

However, because there’s no Will, specific people are entitled to Gale’s estate according to legislation, including two sons from Gale’s previous marriage.

Although Gabby has priority in becoming executor according to legislation, the Court prefers if all beneficiaries, including the two sons, can sign in consent. They refused.

As they could not be convinced, Gabby had to spend a lot of money and time buying a bond policy, which is very expensive and can cost 5% of the entire estate.

Also, as there was no Will or any information regarding what assets and debts Gale have, Gabby had to spend 6 months just finding out the details of his assets. During this time, all of his estate debts accumulated with interest penalties, and she frequently received mail demanding payment of estate debts.

Finally, after a gruelling year, the Court approved the application, and directed that Gabby must distribute Gale’s estate to herself and the two sons according to legislation (Gabby first gets the preferential share, which is currently set as $350,000, and then she gets 1/3 of what’s left, and the two sons equally divide 2/3 of what’s left).

Moreover, as there was also no tax-planning, Gabby had to pay the most expensive probate taxes and income taxes out of the estate funds first before she can distribute what’s left to herself and the two sons.

Moral of the story: setting some assets as automatic transfer and having a valid will is very beneficial. It will save a significant amount of money, time, and agony for your beneficiaries down the line.

Will Drafting, Will Witness, and Lawyer Affdavit

You have just bought a real estate property, which now became your major asset.

Or you just sold your property and now you have liquid funds in your hands.

What happens to your property or your money should you pass away?

With our double expertise in Real Estate and Wills & Estate, many clients get both matters done with us at the same time.

The benefits of having a Will include:

- Your estate will be distributed according to your wishes, rather than according to legislation;

- Other than matrimonial home, all assets you gave to your loved ones in a Will are protected from the spouse if they get a divorce;

- Courts will unlikely require your loved ones to post a bond if you have a valid will. Bond policies are very expensive and difficult to get

At Varity Law, if you hire us to do your Wills, we can also store them FOR FREE in our secure cabinets that have 24/7 surveillance. This is very useful for many clients, as Courts do require originally signed copies when executing your Will.

Corporate Will Drafting and Witness

A shareholder has passed away – what’s going to happen to his shares? What if the sole director passes on and now there’s no one to manage the corporation?

Varity Law will help you plan and structure your corporate documents and shareholder agreement in contemplation of future deaths of directors and shareholders.

Also, by doing a corporate will and corporate minute book with us, your business assets (as long as you are not a public company) can pass onto your beneficiaries without estate application nor estate admin taxes!

To ensure that all aspects of your estate and business affairs are handled with precision and care, consider consulting a business lawyer in Richmond Hill at Varity Law.

Probate Applications

Many types of estate, including those that are not held in a joint account or has a named beneficiary, require going through probate in order to be passed down to beneficiaries.

Whether or not you have a Will, Varity Law is proficient at preparing the probate application to allow the estate trustee to pass down the estate accordance to the Will. Book an initial free consultation with us today.

Estate Property Planning and Transfer

There are many issues unique to estate properties, including:

- What is the most tax-efficient way to pass estate property to my beneficiaries?

- How can I protect the estate property from being split upon the beneficiary’s divorce?

- Properties can be inherited, but mortgages cannot; how would my beneficiaries handle all my estate debts, including mortgages?

For those dealing with estate debts or looking into secure ways to manage estate properties, exploring options in real estate secured lending could provide valuable solutions.

We will answer all that and more. Book a first free consultation with us today.